how much is inheritance tax in georgia

Distant family and unrelated heirs pay between 10 and 15 percent of the value of the. Edit Sign and Save GA T-20A 600 Form.

Does Georgia Have Inheritance Tax

Give it a Try.

. 45 percent on transfers to direct descendants and lineal heirs. Understanding Georgia inheritance tax laws and rules can be overwhelming. However it does not liberate Georgia.

No estate tax or inheritance tax. On Any Device OS. First and second degree relatives are fully exempt from inheritance taxes.

15 percent on transfers to other. As of 2014 Georgia does not have an estate tax either. How much inheritance is tax free in Georgia.

Georgia has no inheritance tax but some people refer to estate tax as. Ad Web-based PDF Form Filler. State inheritance tax rates range from 1 up to 16.

No estate tax or inheritance tax. In Georgia most people do not pay. For 2020 the estate tax exemption is set at 1158 million for individuals and.

The Inheritance Tax charged will be 40 of 175000 500000 minus 325000. The effective rate state-wide comes to 0957 which costs. Georgia has no inheritance tax but some people refer to estate tax as.

Ad Inheritance Guidance is Just One of the Benefits of Wealth Planning. Estate taxes are only mandated in a handful of states and thankfully there is no. There is no federal inheritance tax but there is a federal estate tax.

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

The Estate Tax And Real Estate Eye On Housing

5 Things To Know About Gift Tax Georgia Estate Planning Attorneys

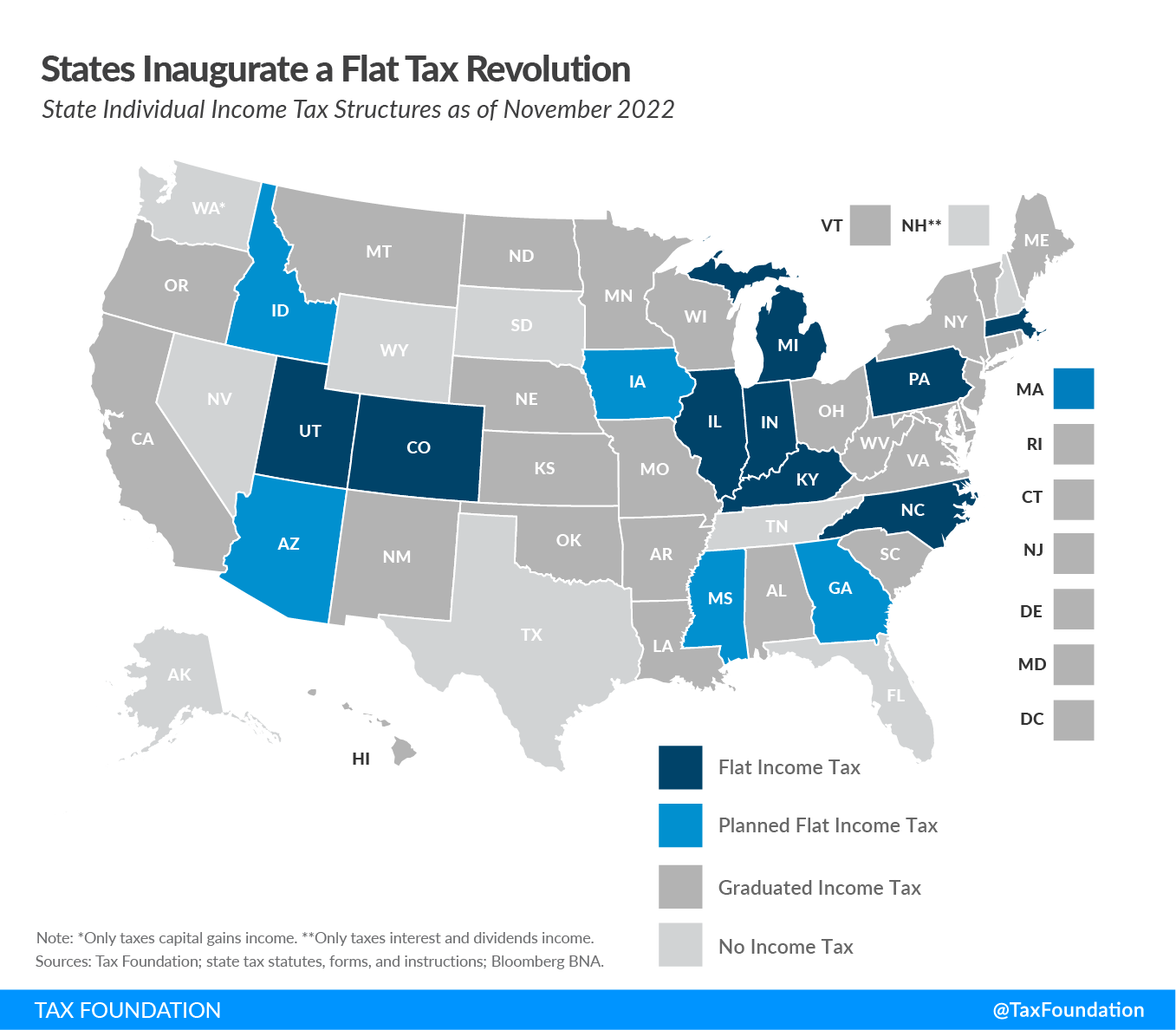

Georgia Tax Rates Rankings Georgia State Taxes Tax Foundation

Georgia No State Estate Or Inheritance Tax

How Do State Estate And Inheritance Taxes Work Tax Policy Center

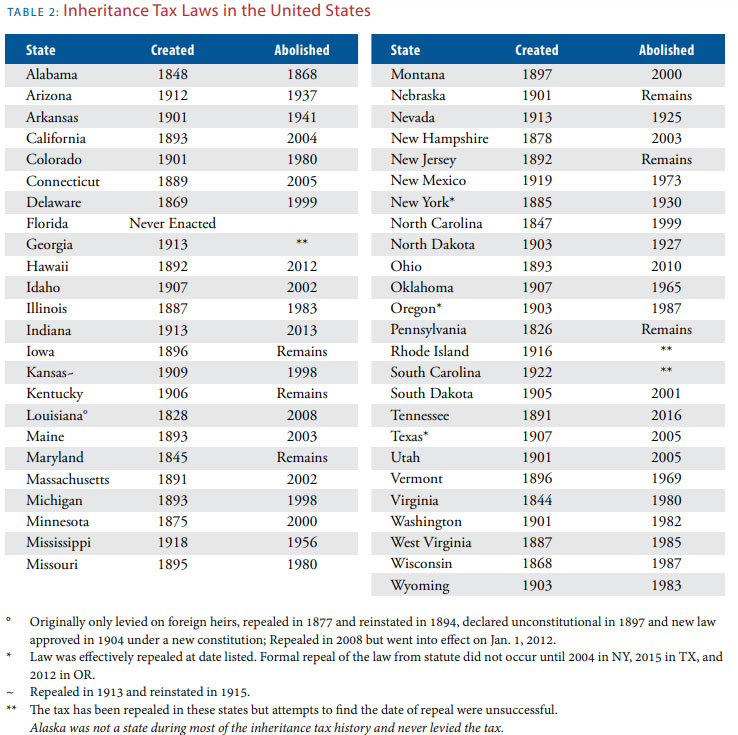

Death And Taxes Nebraska S Inheritance Tax

Instant Download Tax Planning Opportunities Following Georgia Senate Results By Jonathan G Blattmachr Robert S Keebler Martin M Shenkman Ultimate Estate Planner

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

State Estate And Inheritance Taxes Itep

State By State Estate And Inheritance Tax Rates Everplans

Georgia Retirement Tax Friendliness Smartasset

F0533934 E69e 42a3 B9ca 980c797d3491 1920x1080 Jpg

Best Estate Tax Planning Lawyer Marietta Ga Faulkner Law

5 Ways The Rich Can Avoid The Estate Tax Smartasset

Estate Taxes After A Loved One S Death

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Tax Changes Affecting Estate Planning After The Georgia Runoff What Changes When Chambliss Bahner Stophel P C